Mary Poppins Academy: Part One

A common misconception of nannying is that it’s just a job that one has during their college years. From a team of career nannies, we’d love to share with you some things that can help set you apart as a professional nanny.

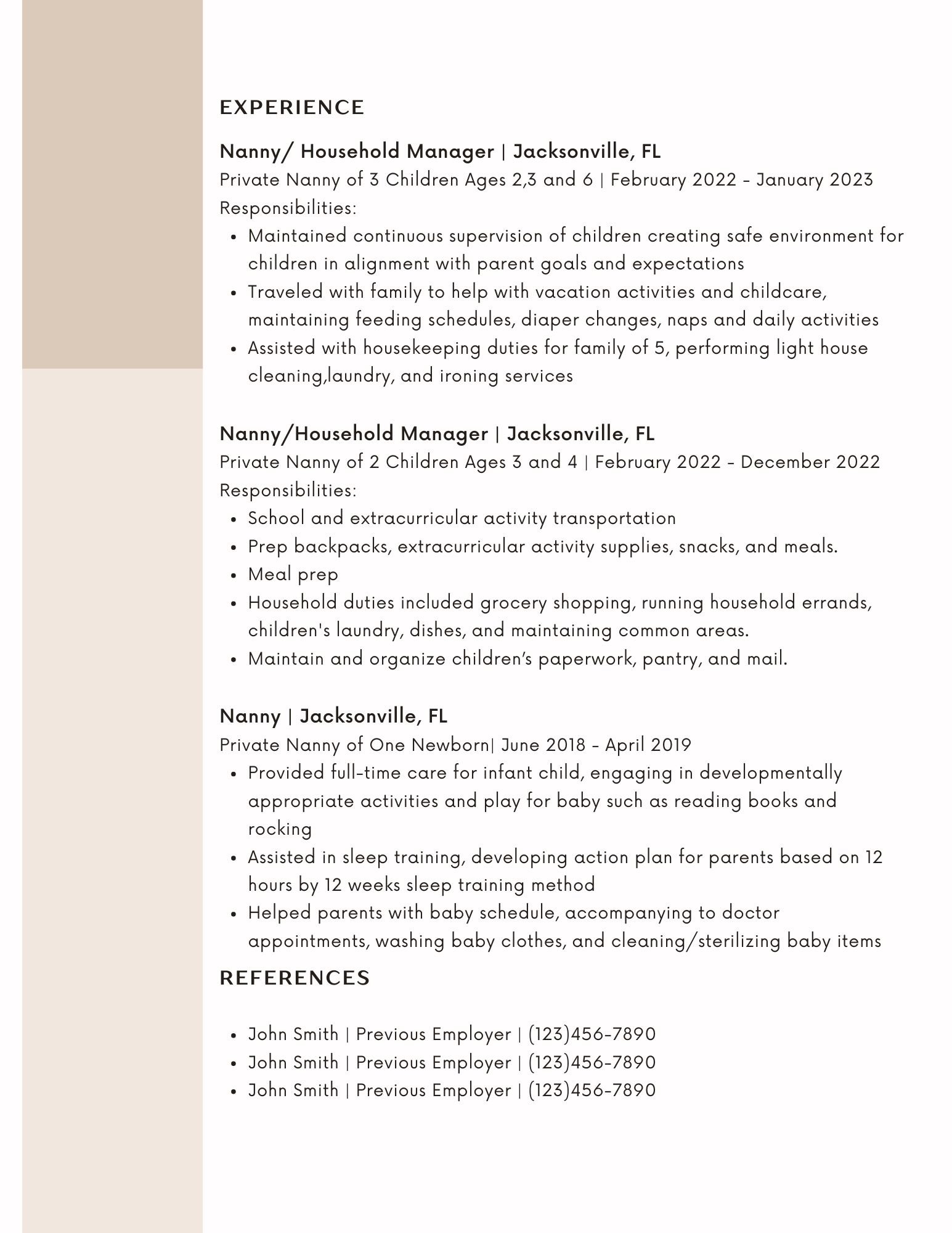

Step One: Resumes

Resumes are not something you want to just throw together. It reflects your experience and qualifications.

Name

Contact info: phone number and professional email

For elaboration: a professional email simply means 90sbaby@yahoo.com isn’t an ideal email for applying for an employment position. Having a simple email based on your name is ideal.

List of Nanny/child related jobs

Description of job tasks you have done in nanny/child related jobs

Education and Trainings

Other related experiences ex. Swim coach, lifeguard. Volunteer with children, mentor

Portfolio of some of the activities you do with the children you work with.

Headshots: These don’t have to be professionally done. A tasteful photo in good lighting can suffice perfectly. We recommend photos with no filters that can distort your photo’s visibility. Along with avoiding smoldering facial expressions and low cut tops. While you want to convey your true self, you do want to convey that you are a professional as well.

Have a sense of formatting in your resume. Having a well structured resume again can help diversify yourself from other applicants.

Here is a sample resume:

Also, fun fact! Creating a Linkedin and Indeed account can boost your visibility for families and agencies searching for nannies.

Step Two:

Implementing the Foundation of a Legal Employment

Requiring to be paid legally: Per IRS publication 926 Nannies are household employees who must be paid hourly, paid time and a half for overtime and have taxes taken out. Families should give their nannies a W4 to fill out when employment starts and then give their nanny a W2 at the end of the tax year. Nannies are not Independent Contractors and should never receive a 1099. If a family tries to make you a 1099 you can file a misclassification here .

You should never be paid “under the table” where taxes are not taken out. This is illegal and would hurt you if you have to be let go and wouldn't be able to sign up for unemployment. During the pandemic, many nannies lost their jobs and had no income because they were being paid “under the table” and therefore couldn’t sign up from unemployment.

It not only benefits you, the nanny, but also the family. When you are paid legally parents may work for companies who reimburse them for a portion of their childcare fees. With some Flexible Savings Arrangements (FSAs) parents can use their funds towards childcare fees.

Requiring a Contract is a must. Having a contract protects you and the family.It benefits both parties because it lays out all expectations for both sides so there isn't any confusion about your job, pay, hours, vacation and sick time, and job duties. Some great resources are The Nanny Counsel contract and A-Z Contract.

Letters of Recommendation: Having letters of recommendations are a great thing to have on hand. People lose touch or managers move on to other jobs or businesses close down and then you don’t have a reference anymore. We recommend asking for a letter of recommendation promptly after ending a position.

Step Three: Social Media Mindfulness

It's highly recommended to keep our online lives censored. With the nature of social media, others could be quick to judge and see things on others' social media and could prevent potential job opportunities. If you chose to have your social media public, just be aware that future employers could come across it. We recommend having your social media pages private and have a professional looking pic as the main picture. Having a tasteful picture or picture of landscape as your profile that’s public for anyone to see is recommended.

Click here to read part two!